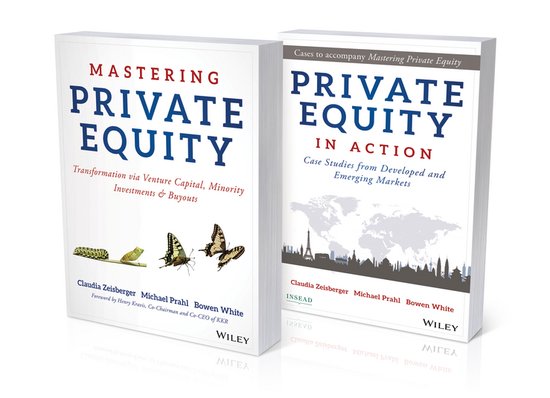

Mastering Private Equity

THE DEFINITIVE GUIDE TO PRIVATE EQUITY

Mastering Private Equity was written with a professional audience in mind and provides a valuable and unique reference for investors, finance professionals, students and business owners looking to engage with private equity firms or invest in private equity funds. From deal sourcing to exit, LBOs to responsible investing, operational value creation to risk management, the book systematically distills the essence of private equity into core concepts throughout the private equity life cycle.

This book combines insights from leading academics and practitioners and was carefully structured to offer:

- A clear and concise reference for the industry expert

- A step-by-step guide for students and casual observers of the industry

- A theoretical companion to the INSEAD case book Private Equity in Action: Case Studies from Developed and Emerging Markets

PRAISE FOR MASTERING PRIVATE EQUITY

"Mastering Private Equity teaches the fundamentals and best practices of PE investing and ensures a deeper understanding of the PE dynamics for professionals from various backgrounds. It shows the potential the asset class has for building better and stronger companies and thereby acting as a force for good for the economy overall."

Professor Ilian Mihov,

Dean of INSEAD

"This is a powerful book, clear on the fundamentals and rich on insight. It accurately describes how private equity worksit also provides nuance on how private equity really works."

Alan MacKay,

Managing Partner GHO Capital and current Chairman of the British Venture Capital Association

"Mastering Private Equity pulls back the shroud of mystery surrounding private equitya succinct yet comprehensive source of information for the expert reader."

Jim Leech C.M.

Chancellor, Queen's University and former CEO, Ontario Teachers' Pension Plan

FEATURING GUEST COMMENTS BY SENIOR PE PROFESSIONALS FROM:

Abraaj • Adams Street Partners • Apax Partners • Baring PE Asia • Bridgepoint • The Carlyle Group Coller Capital • Debevoise & Plimpton LLP • FMO • Foundry Group • Freshfields Bruckhaus Deringer General Atlantic • ILPA • Intermediate Capital Group • KKR Capstone • LPEQ • Maxeda • Navis Capital Northleaf Capital • Oaktree Capital • Partners Group • Permira • Terra Firma

The definitive guide to private equity for investors and finance professionals

Mastering Private Equity was written with a professional audience in mind and provides a valuable and unique reference for investors, finance professionals, students and business owners looking to engage with private equity firms or invest in private equity funds. From deal sourcing to exit, LBOs to responsible investing, operational value creation to risk management, the book systematically distils the essence of private equity into core concepts and explains in detail the dynamics of venture capital, growth equity and buyout transactions.

With a foreword by Henry Kravis, Co-Chairman and Co-CEO of KKR, and special guest comments by senior PE professionals.

This book combines insights from leading academics and practitioners and was carefully structured to offer:

- A clear and concise reference for the industry expert

- A step-by-step guide for students and casual observers of the industry

- A theoretical companion to the INSEAD case book Private Equity in Action: Case Studies from Developed and Emerging Markets

Features guest comments by senior PE professionals from the firms listed below:

- Abraaj • Adams Street Partners • Apax Partners • Baring PE Asia • Bridgepoint • The Carlyle Group • Coller Capital • Debevoise & Plimpton LLP • FMO • Foundry Group • Freshfields Bruckhaus Deringer • General Atlantic • ILPA • Intermediate Capital Group • KKR Capstone • LPEQ • Maxeda • Navis Capital • Northleaf Capital • Oaktree Capital • Partners Group • Permira • Terra Firma

| Auteur | | Claudia Zeisberger |

| Taal | | Engels |

| Type | | Hardcover |

| Categorie | | Economie & Financiën |