Origins Of Value

Presenting a survey of financial innovations that have changed the world, this book shows how the world's important financial tools: loans, interest rates, stocks, mutual funds, the coproatin, and stock exchanges came into being. It ranges from the invention of interest in Mesopotamia to the creation of mutual finds and inflation-indexed bonds.

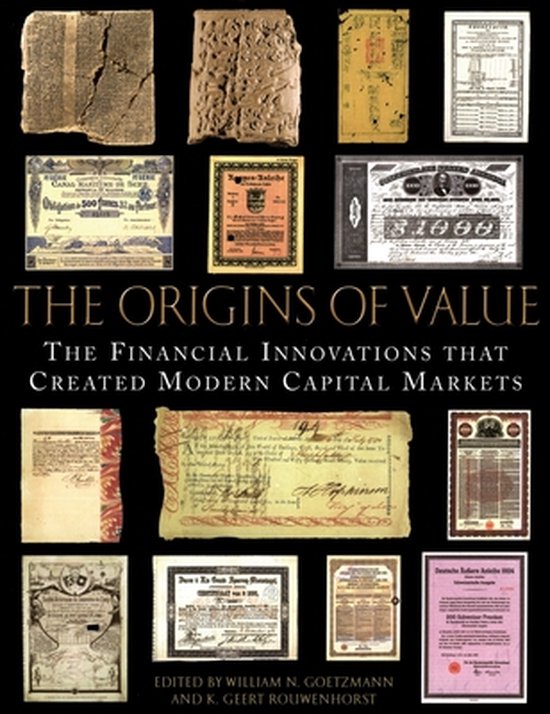

The essays in this volume are written by a distinguished and adventurous set of historians and economists who have been willing, in many cases, to step beyond their typical field of inquiry and explore the historical foundations of financial innovation. The essays are motivated by the need to place our current age of finanical revolution in historical perspective. The continuing process of financial innovation, as sophisticated as it may seem to most of the modern world, is in fact built on surprisingly few basic principles: the inter-temporal transfer of value through time, the ability to contract on future outcomes, and the negotiability of claims. This book traces the evolution of these basic principles of finance through 3,000 years of history - to the dawn of writing. The methodology that is used can be thought of as financial archaeology in the sense that the authors focus on primary survived financial documents to draw their conclusions such as clay tablets, notched sticks, sealed parchment and printed paper. The analysis of original documents is a means for economists to focus on the primary text, to analyze and interpret the object and to move interpretation and understanding of its relationship to modern financial instruments and markets. The result is a collection of interdisciplinary studies of the key innovations in finance from the Old Babylonion loan tablets, to the 1953 London Debt Agreement that span regions in Asia, Africa, North America and Europe.

The essays in this volume are written by a distinguished and adventurous set of historians and economists who have been willing, in many cases, to step beyond their typical field of inquiry and explore the historical foundations of financial innovation. The essays are motivated by the need to place our current age of finanical revolution in historical perspective. The continuing process of financial innovation, as sophisticated as it may seem to most of the modern world, is in fact built on surprisingly few basic principles: the inter-temporal transfer of value through time, the ability to contract on future outcomes, and the negotiability of claims. This book traces the evolution of these basic principles of finance through 3,000 years of history - to the dawn of writing. The methodology that is used can be thought of as financial archaeology in the sense that the authors focus on primary survived financial documents to draw their conclusions such as clay tablets, notched sticks, sealed parchment and printed paper. The analysis of original documents is a means for economists to focus on the primary text, to analyze and interpret the object and to move interpretation and understanding of its relationship to modern financial instruments and markets. The result is a collection of interdisciplinary studies of the key innovations in finance from the Old Babylonion loan tablets, to the 1953 London Debt Agreement that span regions in Asia, Africa, North America and Europe.

| Auteur | | William N Goetzmann |

| Taal | | Engels |

| Type | | Hardcover |

| Categorie | | Economie & Financiën |